can you opt out of washington state long-term care tax

Can you opt out of washington state long-term care tax Saturday August 13 2022 Employers will not be required to collect the 58 payroll tax until July 1 2023. The Long-Term Care Trust Act was signed.

Ltca Long Term Care Trust Act Worth The Cost

I have not had success.

. Washington states Long-Term Care Trust Act is set to take effect at the beginning of 2022 and the only time to opt out of the new tax is fast approaching. The employee must provide this approval letter to his or her employer. 1 2023 exemptions granted to military spouses non-immigrant visa holders and those living outside Washington will not be permanent.

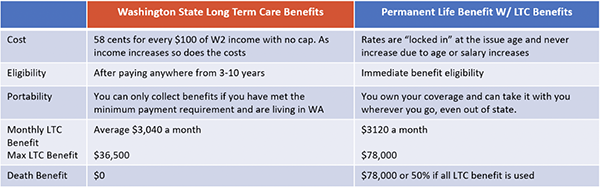

Lets assume for the moment that you dont opt-out of the Washington long-term care tax program before the December 31 2022 deadline. This amounts to 580 annually for a W2 income of 100000. If you qualify for benefits in the program you can receive lifetime long-term care benefits of up to 36500.

This is also true if you move to Washington state after the opt out window closes after 12312022 and you didnt already own long-term care. On October 1st the window to opt-out of Washington States Long-Term Care Tax opened. The program is supposed to remain solvent.

For those who got in before the site crashed minutes after it opened I hear it was easy. We suggest you visit it during off-hours early morning late evening or the weekend. The money collected will go into the WA Cares Fund.

Opting back in is not an option provided in current law. Lets assume for the moment that you dont opt-out of the Washington long-term care tax program before the December 31 2022 deadline. Workers already approved for a permanent WA Cares exemption because they hold a long-term care insurance plan do not need to reapply.

In that case the tax will be permanent and mandatory. It is unclear whether the tax rate will remain at 058. Opting Out of The Washington State Long-Term Care Tax After an employees application for exemption is processed and approved he or she will receive an approval letter from ESD.

Washington S Long Term Care Act. The average cost of assisted living with memory care in Washington is around 235 per day. The website has been overwhelmed with visitors.

26 2021 inviting passersby to come in and ask questions about Washingtons long-term care tax. Care in a nursing home could be even more and long term care may be needed for more than a year possibly much more than a year. On the Create an Account page select the Create an Account button to the right of WA Cares Exemption.

However earlier this year the Legislature approved a one-time opt-out provision for anyone who obtains a qualified private long-term care insurance plan before November 1. A sandwich board sits outside an insurance brokers office in Seattles Fremont neighborhood on Aug. The initial premium rate is fifty-eight hundredths of one percent of the individuals wages 58.

But for most employees the delay of the programs start doesnt give them any more time to find a way to avoid the tax. If you have private long-term-care insurance LTCI and want to opt out of a new long-term-care payroll tax starting in January you can apply for an exemption with the state of Washington starting today. Anyone who works in Washington but resides in another state Spouses of military personnel stationed in the state of Washington Disabled veterans and.

This is possible because starting on January 1 2022 employees who do not opt out of the program will begin paying a 058 payroll tax on all eligible compensation. Starting January 1 2022 employers will begin withholding a new payroll tax from employee paychecks as a premium payment for the new long term care benefit. To qualify for an exemption you must be at least 18 years old and have proof of an eligible LTC policy.

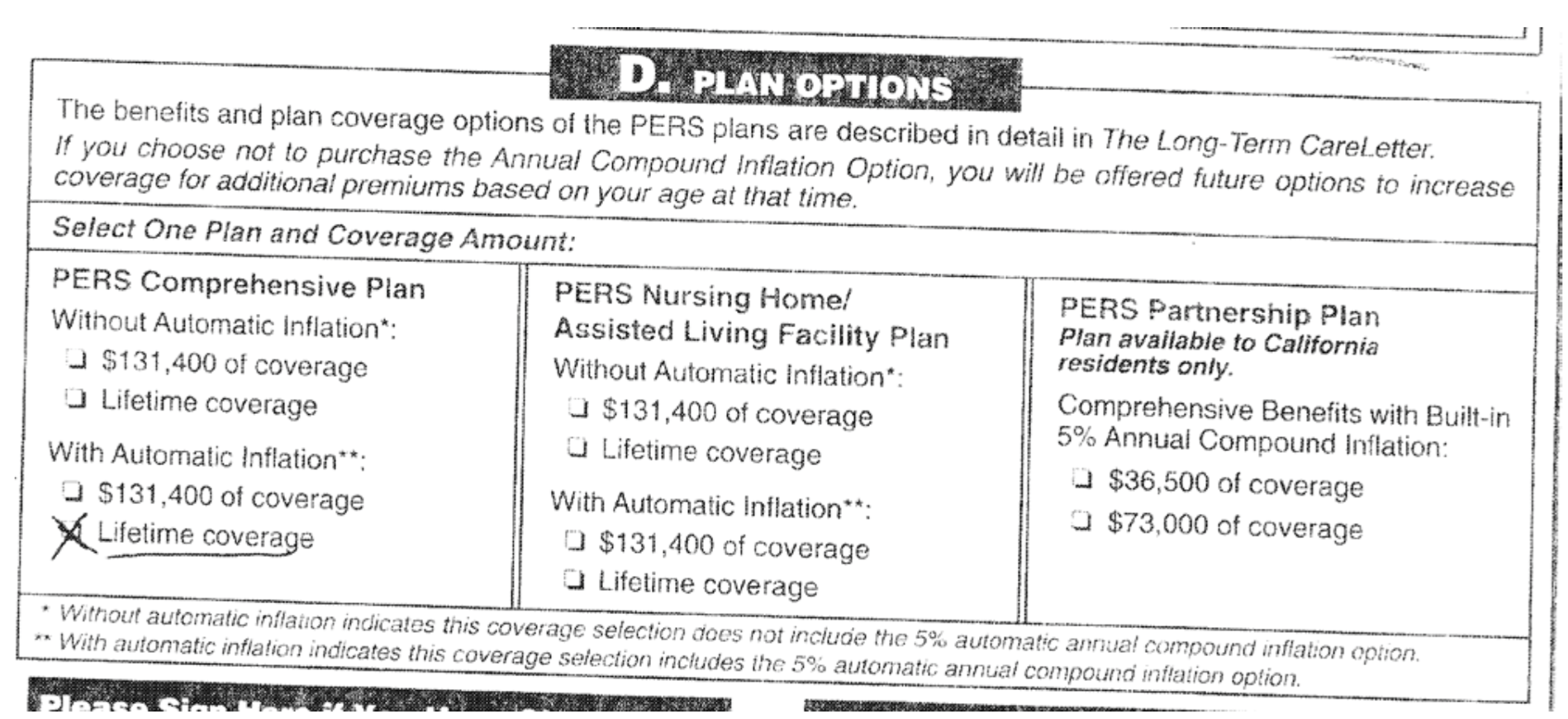

With the update of the Washington Long-Term Care Trust Act about 250000 MORE workers are able to opt-out of the program IF they fall under one of these four new categories. Applying for an exemption Once youve logged in and selected Paid Family and Medical Leave from your list of services in SAW youll click Continue to proceed to creating your WA Cares Exemption account. To apply navigate to the WA Cares Fund website and select Apply for an Exemption.

Employers must maintain copies of any approval letters received. Washington workers who live out of state temporary workers on nonimmigrant visas spouses of active-duty military members and veterans with service-connected disabilities can all seek opt-outs starting in January 2023. If you have purchased a private long-term care policy you should start the application process soon.

You do not need a copy of your policy to file the exemption.

Long Term Care Benefit Through Chubb Afscme Council 28 Wfse

Health Care Costs In Retirement What To Expect How To Plan

Free Washington Living Will Template Faqs Rocket Lawyer

Payroll Tax Is One State S Bold Solution To Help Seniors Age At Home Kaiser Health News

What To Know Washington State S Long Term Care Insurance

Ltca Long Term Care Trust Act Worth The Cost

Home Long Term Care Insurance For The Ones You Love

What To Know Washington State S Long Term Care Insurance

Home Long Term Care Insurance For The Ones You Love

Primary Care Estimating Democratic Candidates Health Plans Committee For A Responsible Federal Budget

Can A Long Term Care Insurance Policy Be Cancelled By The Insurance Company Long Term Care Insurance For The Ones You Love

Washington S Long Term Care Act

What To Know Washington State S Long Term Care Insurance

What You Need To Know About Washington State S Public Long Term Care Insurance Program

Calpers Long Term Care Policy Train Wreck Is Bankruptcy The End Game Naked Capitalism